The Accountancy Board of Ohio's Online Renewal System Requires CPAs to answer specific, CPE related questions

LCvista offers a solution to Ohio's reporting requirements by recommending use of the Ohio Compliance Details export, which contains all of the required information necessary to copy/paste into the OH online Form.

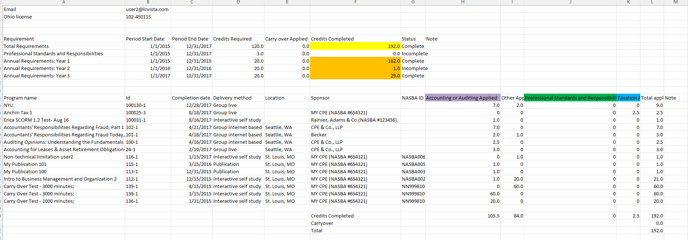

The example attached titled “LCvista Ohio Renewal CPE Report” includes the answers to the following questions asked by the Board:

- Have you completed at least 120 credits (or 40 credits if a newly licensed CPA) of continuing professional education (CPE) in accordance with Ohio Administrative Code 4701-15, as of today?

- Yes/No Answer: Reference Total Requirements, Credits Completed (highlighted above in Yellow)

- If you currently hold a permit, did you complete at least 20 CPE credits in each of the last three calendar years, per OAC 4701-15-02? Those who are newly licensed, changing their licenses status from registration to permit, or who are renewing late should indicate N/A.

- Yes/No/NA: Reference Annual Requirements, Credits completed (highlighted above in orange)

- Enter the number of CPE credits earned in the first year

- Numeric value: Reference Annual Requirements, Credits completed (highlighted above in orange)

- Enter the number of CPE credits earned in the second year

- Numeric value: Reference Annual Requirements, Credits completed (highlighted above in orange)

- Enter the number of CPE credits earned in the third year

- Numeric value: Reference Annual Requirements, Credits completed (highlighted above in orange)

- Enter the total Credits of CPE completed during the reporting period

- Numeric value: Reference Total Requirements, Credits Completed (highlighted above in yellow)

- All permit holders are required to complete three (3) credits of Board approved professional standards and responsibilities (PSR) during each three-year reporting period. Enter the total credits of PSR completed

- Numeric Value: enter total credits completed in professional standards and responsibilities, Credits Completed (highlighted above in green)

- Current permit holders who perform tax work on any engagement, prepare any tax return, or sign any tax return as a certified public accountant in accordance with professional standards are required to complete at least twenty-four (24) CPE credits in the field of taxation during the three-year reporting period. Enter the total taxation credits completed

- Numeric Value, enter total credits completed in Taxation Applied column (highlighted above in blue)

- Current permit holders who perform accounting, auditing, assurance or attestation engagements, prepare any financial report, or sign any financial report in accordance with professional standards are required to complete at least twenty-four (24) CPE credits in the fields of accounting, auditing, or attestation standards during the three-year reporting period. Enter the total accounting and auditing credits completed

- Numeric Value, enter total credits completed in Accounting or Auditing Applied column (highlighted above in purple)

- Enter the total amount of remaining/other CPE credits completed

- Total amount remaining of other credits completed = Total Credits requirements- A&A Applied - Taxation Applied- PSR Applied

- From example above: 192-105.5-2.5-0=84